November 11, 2020 – West Bend, WI – On a 6 – 2 vote the West Bend common council approved raising taxes for 2021. Those voting in favor of rasing taxes 7.94% were aldermen John Butschlick, Mark Allen, Brett Berquist, Jed Dolnick, Steve Hoogester, and Justice Madl.

Those voting against were aldermen Randy Koehler and Meghann Kennedy.

Prior to the vote Kennedy, who also heads the finance committee, offered an option to the council.

Prior to the vote she rolled out a couple options so the council did not have to raise taxes as much during a time when she said people are dealing with the effects of “COVID” and “unemployment.”

Below is her presentation.

I wanted to take a minute to show some graphs I made to help people visualize and understand the budget and more importantly how we are trending in our spending in the City of West Bend.

I am a strong believer that the goal of our budget should be to raise only the amount of money needed to fund necessary functions of government while doing the least amount of damage to the economy and respecting our taxpayers.

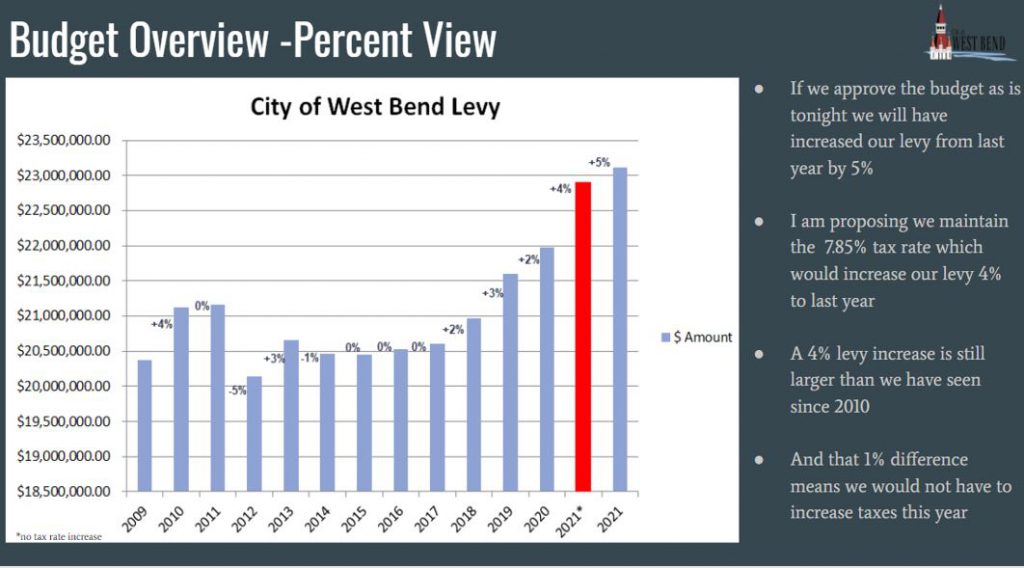

This chart shows the Levy dollar amount represented by each year with a blue line.

Along the left is the dollar amount of the levy. And along the bottom is the year.

The Black number to the left of each bar represents the percent increase/decrease to the levy from the YEAR PRIOR

If you look to the right of the graph you will see 2021 has TWO lines.

One is blue on the far right (that is the proposed budget as written which will require a tax increase on our residents) and one is red is what I am proposing for the budget this year, which WOULD NOT require a tax increase on our residents.

The Red line is REALLY REALLY good news! It shows that due to our new construction in West Bend we are able to increase our city levy by 4% this year and while NOT raise taxes!

A 4% increase to our Levy is a larger increase than we have seen in 10 years! West Bend is in a good spot financially with what we have coming in without a needing a tax increase.

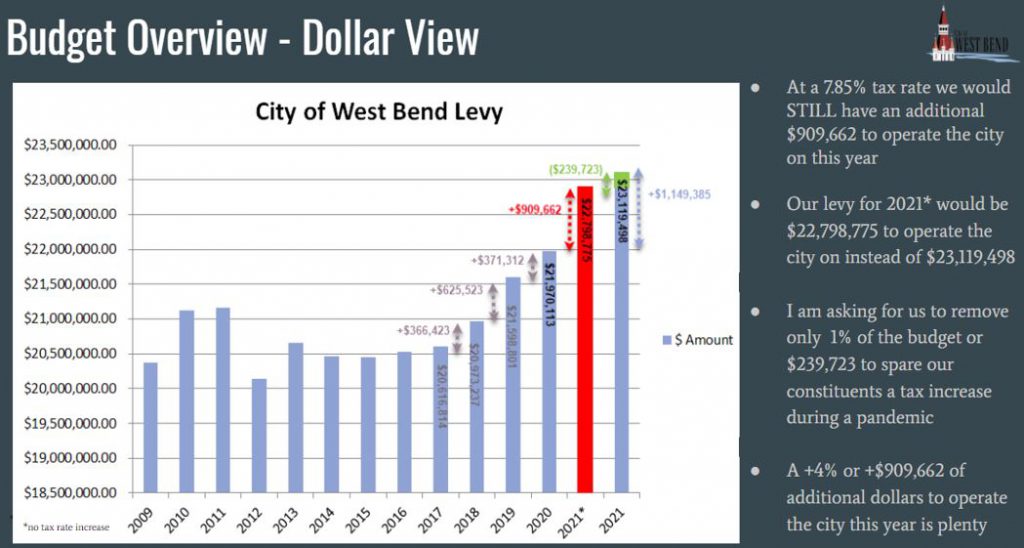

I know some people will want to look at this in terms of dollars and not just percent’s, so here is what this looks like in dollars.

As you can see the red bar (which is the maintaining of 7.85% tax rate so no tax increase) the 4% growth to the levy equates to an additional $909,662 to our levy to operate the city with from last year.

The levy I am proposing is $22.7M vs $23.1M

If we look to the far right 2021 blue bar which is the 7.94% increase taxes we are ONLY getting an additional $239,723 dollars more from the tax increase (The green small tip of the far right bar).

That green piece shows the dollar difference between the tax rate staying the same (red bar to the left) and the tax rate increase.

If we look back in past years, we can also see the dollar increases to the levy we have seen for the past few years.

The proposed $909,662 increase is already a 2.5x what we increased from 2019 to 2020. The $909k increase is more than we have increased in dollars in well over 10 years.

I am asking for us to remove 1% from our budget ($239k) just that green tip so we can spare our tax payers an increase during a pandemic, and during a year where we ALREADY are giving the city government MORE MONEY than we historically have to operate the city on.

I feel that the +4% increase or $909k of additional dollars we are able to put in the levy from last year is plenty and we will be able to make this work.

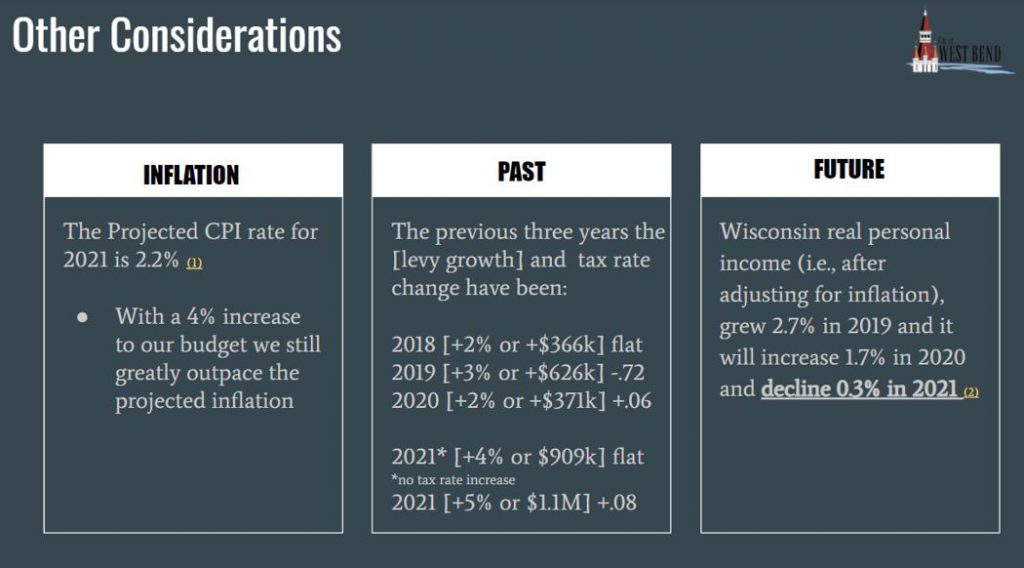

I want to look at a few other factors that I think we should also consider.

The rate of inflation or CPI for 2021 is 2.2% . So even with a 4% increase to our levy we are outpacing the rate of inflation.

Looking back at our previous year levy increases we can see the percent and dollar increase have been lower than what I am proposing this year, which would not cause a tax increase.

We were able to operate the city in previous years with 2-3% increases and $366k – $626k increases and now this year, during COVID where our people are hurting we CAN NOT make a 4% increase and an additional $909k work, we have to raise taxes to get that extra $240k.

Looking forward it is likely that Wisconsin residents will have to “do more, with less” in 2021. According to a WI department of revenue forecast, if we look at the estimated real personal income we can see that 2021 is estimated to decline by .3% where in 2020 it increased 1.7%

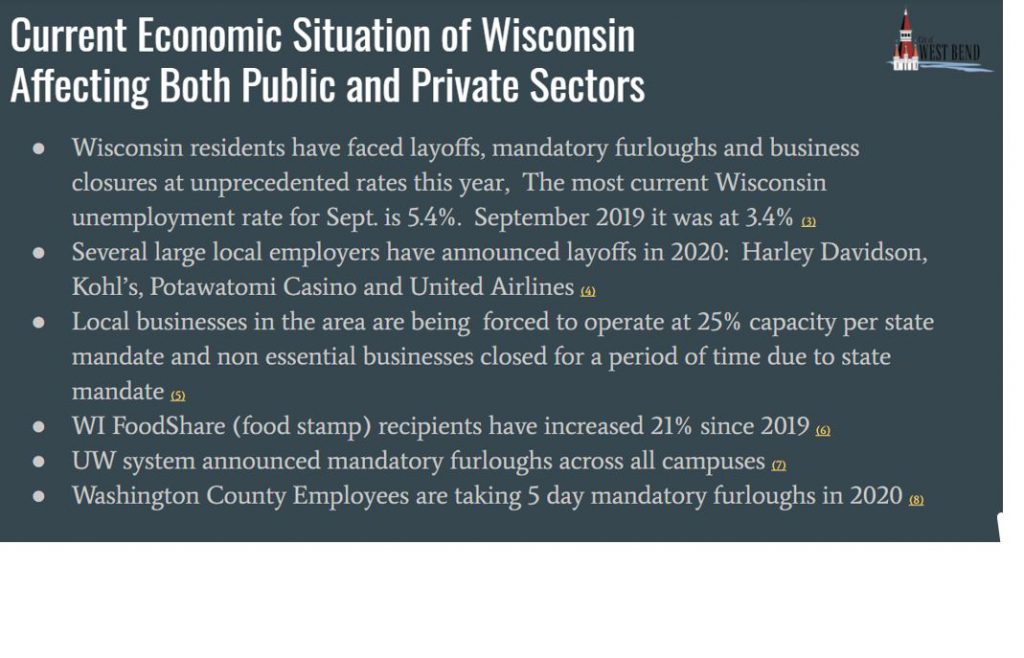

I know I have touched on this before but we know that the unemployment rate in WI is almost double to what it was last year.

I know I have touched on this before but we know that the unemployment rate in WI is almost double to what it was last year.

We are seeing a lot of layoffs from large local employers including Harley Davidson, Kohl’s, Potawatomi and United Airlines

We know MANY of our local businesses, as well as West Bend bars and restaurants and their employees are suffering under the limited capacity order that has been passed as well as the forced shut down lasting for a period of time earlier this year to “non essential businesses”

Food Stamp recipients in the state of WI have increased 21% since 2019

And I know that we had a little bit of a debate a few weeks back how private and public sectors can’t be compared but I wanted to point out two public sectors that are furloughing as cost cutting measures and that is the Washington County Government employees as well as the UW employees across all campuses.

I wanted to share that as I think it is important to note that both public and private sectors are struggling to deal with COVID impacts.

Click HERE for more specifics on where the tax increase is going.

Raise taxes for what, exactly? Our schools suck and our roads are horrible. We have to pay to get into county parks now, our city parks could use a facelift.

Neighbor, there is a link above for more info.

Click HERE for more specifics on where the tax increase is going.